New DOE Funding Initiative Allocates $134 Million to Strengthen Domestic Rare Earth Supply Chains

Industrial News

Dec 2, 2025

The U.S. Department of Energy's Office of Critical Minerals and Energy Innovation has announced up to $134 million in funding to bolster domestic supply chains for rare earth elements (REEs). It marks a significant push to reduce American dependence on foreign sources for these critical materials.

$134M to Extract Rare Earths from E-Waste and Mine Tailings

Rare earth elements—a group of 17 chemical elements including neodymium, dysprosium, terbium, praseodymium, and yttrium—are critical components in technologies spanning clean energy, defense systems, and advanced manufacturing.

These materials enable high-performance permanent magnets used in electric vehicle motors, wind turbine generators, precision-guided munitions, radar systems, and countless consumer electronics.

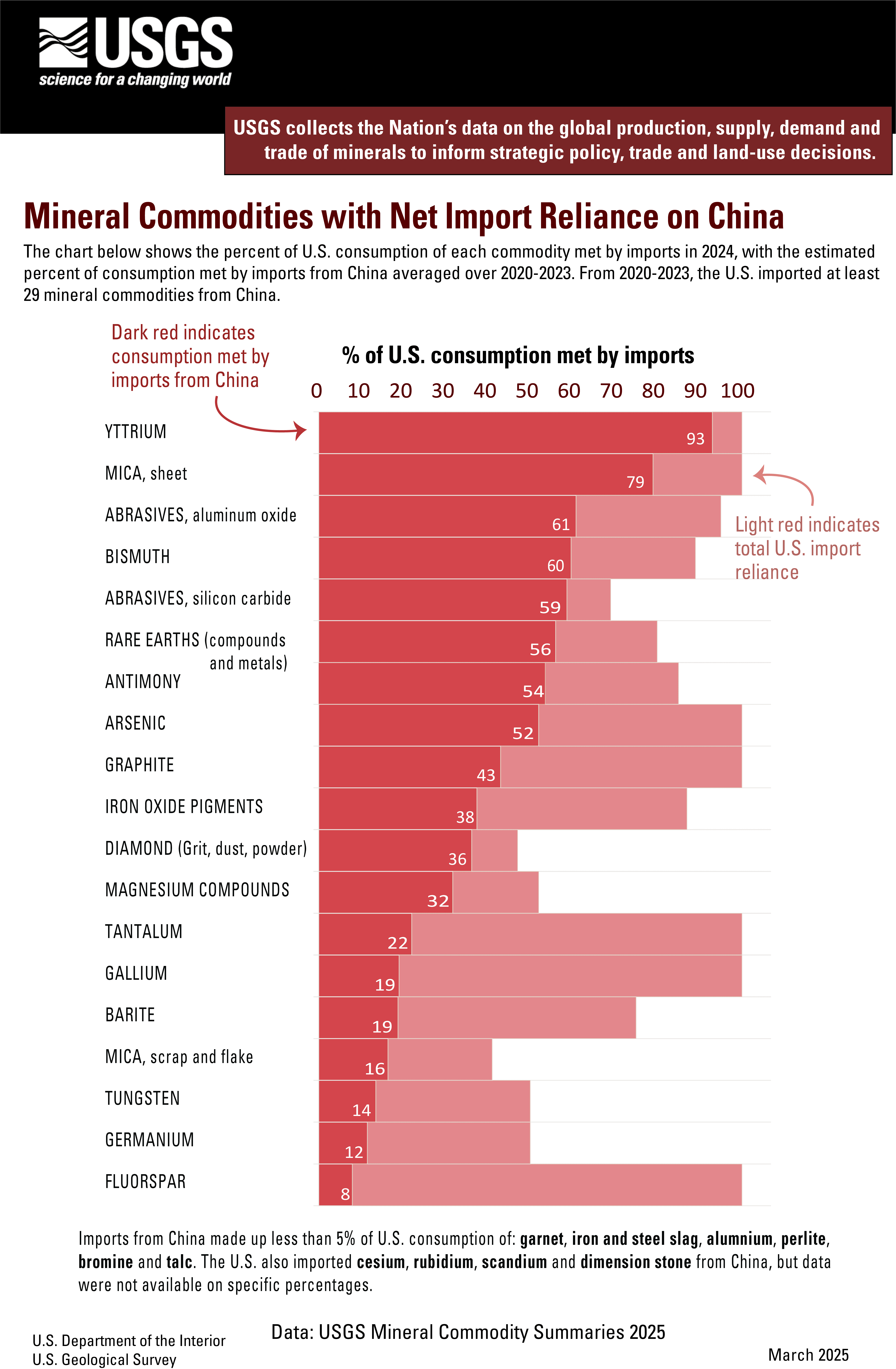

Source: Minerals with Net Import Reliance on China By Mineral Resources Program.

Specific focus areas for the funding include the extraction of these elements from feedstocks like mine tailings, electronic waste (e-waste), and other waste materials.

The initiative aims to reduce American reliance on foreign imports. It supports projects that prove it is possible to recover and refine these materials from unconventional sources.

Why Unconventional Feedstocks Matter?

The focus on unconventional feedstocks—mine tailings, coal waste, industrial byproducts, and electronic waste—represents a pragmatic approach that can accelerate results while keeping costs manageable. Research has shown that abandoned mine tailings can contain significant quantities of rare earth elements.

One study of the San Quintín mine area estimated approximately 168 tons of REEs in 1.7 million tons of mine tailings, with concentrations ranging from 0.8-2.9 mg/kg for scandium to 16.9-88.8 mg/kg for cerium. Rare earth elements can also be found in coal waste, particularly in coal combustion residues and acid mine drainage.

Research in Pennsylvania identified approximately 2 billion cubic yards of coal refuse that could serve as potential feedstock.

Electronic waste represents another promising source, as urban mining—recovering rare earths from electronic waste—could meet up to 20% of global demand by 2030, according to the United Nations University.

By repurposing existing industrial infrastructure for mineral recovery rather than starting from scratch, this approach can speed up project timelines, reduce environmental footprint, and convert environmental liabilities into strategic assets.

Understanding the Strategic Imperative

According to figures from the U.S. Geological Survey, the United States relied on imports for about 80% of the rare earth elements it used in 2024. More than half of these imported rare earths—56%—came from China.

This means most of the rare earths used in American manufacturing and technology were brought in from other countries, with China as the main supplier controlling approximately 60% of global rare earth mining production.

As Eugene Gholz, former Pentagon rare earths expert, explains:

You can have all the mines you want, but without processing capacity, you're still dependent on China.

This concentration creates multidimensional vulnerabilities for Western economies, particularly given China's history of leveraging its rare earth dominance as a geopolitical tool.

The DOE's $134 million investment in domestic rare earth supply chains represents a fundamental restructuring of America's strategy for securing strategic materials, impacting energy infrastructure, manufacturing competitiveness, and national defense capabilities.

For companies in technology, electric vehicles, renewable energy, defense, and advanced manufacturing sectors, this funding creates opportunities to develop more resilient, domestically-focused supply chains.

Building Global Partnerships to Secure Supply

The United States has accelerated efforts to secure critical mineral supply chains by entering new agreements with key allies across the globe in late 2025. Since October, the U.S. administration has concluded strategic frameworks with Australia, Japan, Saudi Arabia, Malaysia, and Thailand. The aim is to reduce supply chain concentration risks and bolster downstream processing capacity for minerals such as rare earths, cobalt, and uranium.

Energy Secretary Chris Wright described the funding as a necessary step to rebuild the nation's ability to process materials essential for economic security, stating:

We have these resources here at home, but years of complacancy ceded America's mining and industrial base to other nations. Thanks to President Trump's leadership, we are reversing that trend, rebuilding America's ability to mine, process, and manufacture the materials essential to our energy and economic security.

This domestic investment parallels recent international efforts, including minerals framework agreements established with allied nations such as Australia, Japan, and Saudi Arabia.

The Funding Opportunity: Details and Timeline

Through this Notice of Funding Opportunity, DOE will support projects that demonstrate the commercial viability of recovering and refining REEs from unconventional feedstocks. This approach transforms waste streams into valuable domestic supply chains while addressing both environmental remediation and mineral security objectives simultaneously.

Applicants must submit non-binding letters of intent by December 10, 2025, with full applications due by January 5, 2026. To qualify, project teams are required to include an academic partner, and funding recipients must provide a cost-share of at least 50%.

This initiative follows a broader pattern of federal investment, including a previously announced $355 million for two notices of funding opportunities to expand domestic production of critical materials.

Key deadlines for applicants:

Letters of Intent: December 10, 2025, at 5:00 PM ET

Full Applications: January 5, 2026, at 5:00 PM ET

Informational Webinar: December 9, 2025, at 1:00 PM ET

The Supply Chain Risk Challenge

While this funding presents tremendous opportunities for domestic rare earth production, it also introduces significant supply chain risk, compliance, and ESG challenges that companies must address proactively. As supply chains shift toward new mines, recycled feedstocks, and alternative suppliers, several risk categories emerge:

Supplier Verification and Due Diligence - New entrants to the rare earth supply chain—whether mining operations, recycling facilities, or processing plants—require rigorous vetting to ensure they meet operational, financial, technical, and regulatory standards. Companies must verify that potential suppliers possess the technical capabilities to consistently deliver materials that meet specifications for high-tech and defense applications.

Environmental, Social, and Governance (ESG) Compliance - Mining and extractive industries face unprecedented ESG scrutiny, with stakeholders ranging from investors and customers to host communities and regulatory agencies demanding accountability and transparency. Mining critical minerals carries inherent environmental and social risks, including high environmental footprint through emissions and land use, biodiversity loss, water stress and tailings management challenges, and community relations and social license to operate.

Traceability and Transparency Requirements - Growing expectations for companies to understand the origins of components have been driven by regulatory and financial factors, particularly concerning conflict minerals and critical materials essential for electronics, vehicles, and energy transition technologies. Supply chain traceability—collecting accurate, tier-by-tier data for accountability—creates a verified record of the who, what, and where behind each item, including facility IDs, GPS coordinates, batch and lot codes, and certificates.

How Parakeet Risk Enables Strategic Growth?

As companies seek to capitalize on the DOE's $134 million investment and engage with emerging domestic rare earth supply chains, Parakeet Risk provides the innovative supply chain risk solutions necessary to seize opportunities without encountering hidden risks.

For more information about the DOE funding opportunity, visit the official announcement at energy.gov. To learn how Parakeet Risk can support your supply chain risk management strategy as you engage with emerging rare earth suppliers, contact our team.